SOCIALS

Toofr LLC monthly report: Nov 2017

In: Business

Tags: #toofr #entrepreneurship #saas #finance

Welp, it was a mostly rough month last month but December is already pointing in a much better direction. I think Q4 in general has been a transition from big customers to smaller ones. Although I've lost MRR again, the total number of customers has held steady.

There's much to improve but I'm optimistic that October and November represented a seasonal reset and December into Q1 next year will have me back on the up and up once more.

Referral traffic update

Referral traffic dropped 19% month-over-month. I had to dig into the referrers to find the source because on skim it was obviously not an across-the-board kind of drop. One of my big referrers must have removed a link, and it didn't take me long to find the culprit.

Although I'd rather have this link than not have it, the referrals it's been yielding have not been the highest quality. They take up support time and rarely convert, and when they convert it's been at my lowest $19/mo tier.

Also on further investigation, the dropped link happened in the third week of October. I didn't catch it last month. At the time of this writing, I haven't had the benefit of that traffic for nearly six weeks. It was a major source of referral traffic and I could draw the connection between this 20% traffic drop and a 20% drop in new customers in November, from 37 down to 32, but I'd rather not. I'll just assume for now that it's noise.

If you've been reading these for the last three months then you've been able to witness a real honest-to-goodness struggle for eyeballs in an increasingly fragmented and commoditized niche market of email guessing.

Ever the optimist, I see early signs of the clouds parting this month already, but man, it's a fierce battle even for referral traffic.

Organic traffic update

Organic traffic fell 5% month over month. I notice also in SEMRush that a lot of the keywords I'm tracking on Toofr have fallen in the past 30 days, some by as much as 35 positions.

This SEMRush report is really helpful and it's one I haven't used before because I needed to upgrade. Since it's an all-out battle right now to get this fixed I'm signing up for every tool I can get to stop this bleeding.

I compare Toofr to Hunter.io in all of my major keywords and there's really no comparison. They dominate SEO in this niche and it's been a struggle to catch up. I have some strategies to fix it and will start with the obvious: reverse-engineer their SEO by looking at the source on some of their best ranked pages and figuring out what the hell they're doing that I'm not.

I am going to reverse this trend in organic traffic and SERP positions! This, unlike the referral traffic problem I've mentioned before, is something I'm supremely motivated to do. My competitive mojo is boiling hot on this front of the war. It's on.

!(https://media.licdn.com/dms/image/C4E12AQEGEvSJdWo6qg/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=mlljILQVsJLRVFFGYr8y_MDRm9e8eW4m5CdXDOFphok)

Marketplace traffic and sales update

This too took a hit last month, dropping 35% month-over-month. There were no new lists added but I had seven marketplace purchases.

The traffic fell across the board, unfortunately, so I can't attribute it to any single list or index page. They all got 10-30% fewer views in November than in October.

Merchandising the marketplace lists better has been #1 on my product roadmap for months but I keep kicking it back down to fix some data issues for a few API customers. I have to put that revenue priority ahead of marketplace, but I think I'm in a good enough spot now to focus on marketplace merchandising starting next week.

I want November to be a little blip in the overall trend. I should be able to control the traffic trend in this part of Toofr. I'm going to prove that I can do it.

!(https://media.licdn.com/dms/image/C4E12AQFZ575TNjJAMQ/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=sBhtXodMH6m0qQ7WcKx3j1ElU9ZA3YmzcH2scK5Bh5E)

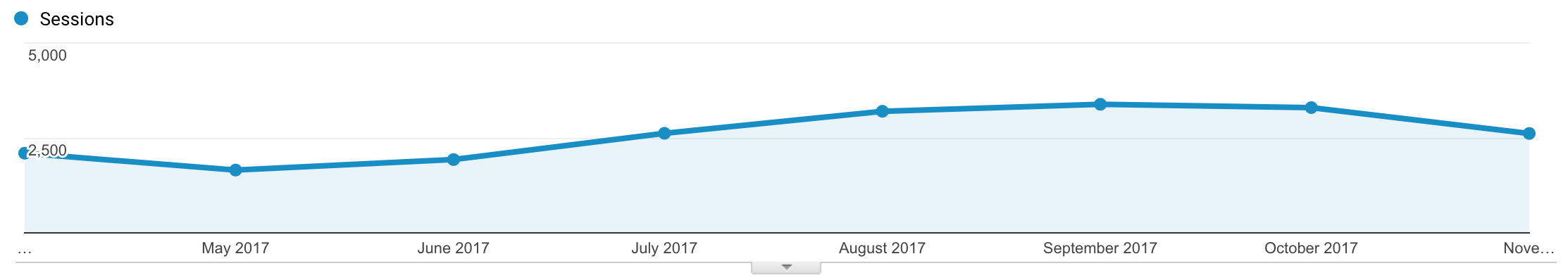

Overall traffic update

Overall I'm down just over 5% month-over-month. A bump in direct traffic offset my drops in organic and referral. So the overall picture isn't as dire and the areas I drill down on for these monthly reports but still, I look forward to sharing some good news again.

Could it be seasonal? I hope so. Q4 last year showed a similar monthly decline and it didn't pick up again until March. My assumption has been that the pickup was due to my being able to focus on Toofr traffic and SEO again after essentially dropping it for a year while I was CEO of Scripted and trying to navigate its exit. But who knows, maybe this decline I'm seeing now will also extend into Q1.

I'll fight it, at least on the organic and marketplace list battles, I will fight.

!(https://media.licdn.com/dms/image/C4E12AQGp6Ww7ekDm7Q/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=n8Vlpi-6nMda6WGL5pb4-JjgVVRvfXFRuHrin_S-DaA)

Customer growth

The good news is I acquired another $1,100 of new customers in November. The bad news is I churned $3,600 of them too.

This obviously can't continue, but I don't think it will. I wrote in the intro that I seem to be having a transition of sorts as larger customers are churning and being replaced with smaller ones. As a macro trend, I'm ok with this. During this transition it will appear to be a bloodbath, but so long as my overall customer count is holding steady or growing, then I'm not overly concerned.

I hate to lose MRR, but so long as my customer count isn't tanking as well, I can rest assured that I will get it back. Eventually.

!(https://media.licdn.com/dms/image/C4E12AQFQV3E9JYrKvQ/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=j02eOfFmcIIUmVXnDVcaaZd_jbqcfWi-nvxSRPLRxbg)

On the flipside, I held the customer count steady despite a dramatic spike in both voluntary and delinquent churn.

I signed up for ProfitWell's failed payment retention service and even they have expressed some surprise at the numbers. It's turning around, though. A week into December and I can already tell this will not be the same story as November. I'm ahead in MRR, churn is way down, and, if I'm being honest, I've done nothing differently.

So goes the whims of the SaaS gods.

However, if I was going to pay strict attention to one and only one chart, this is the one I would pick. It's the number of paying customers each month.

!(https://media.licdn.com/dms/image/C4E12AQHVAcudGdi59g/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=nA3L2PCR-hqWPs5MdqKeU0Efx1ldkRglRiHtLqnWjNI)

Others might argue that MRR is the right one. For argument's sake, let's take a look.

!(https://media.licdn.com/dms/image/C4E12AQEYKLSHB8ICyQ/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=tHbna6gWJGnrBaC4LqTv2tzXfomPhPHScjvlTO11Ul4)

It tells a more dire story. The MRR component of my business has fallen for two months in a row. If Toofr were purely MRR, then yes, I agree, this is the hair-raising chart that I should be focused on. But Toofr is not just subscription revenue. There are users who go over their credit limits all the time, effectively purchasing credits in an e-commerce fashion. There's the marketplace piece too which, although small, remains a big future opportunity.

For the e-commerce and marketplace elements to work, I need customers. Because I'm still playing the long game here, so long as I'm growing the base of active paying users, I'm still a player in the market and getting stronger every month. That's the overall customer strategy I'm banking on.

Overall revenue and net income

Cash was still over $20K in November. I don't like losing money but it's going to happen and Toofr is still wildly profitable. That's a part of this game that I need to remind myself sometimes.

I don't have employees. I don't have investors. I'm the only one fretting about a drop of $3K in my monthly cash collection. The fact is I'm still making more than I need to survive has a homeowner in the Bay Area. That alone is a major feat. Doing it on my own terms with my own business, working for myself, is icing on the cake. So hey, here's a pat on my own back.

!(https://media.licdn.com/dms/image/C4E12AQGxzA1_VjfnYg/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=BZ0WJQrMwSO9rhTCt5NHtlcd62p_SA42qE80--vP1XM)

Now let's go put that $3K back on the board next month. And since I'm writing this in mid-December, I can already tell you it's a heckuva lot better.

So the P&L is flat. There's not much more to say than that. Gross margin is low because a lot of the COGS has room for leverage. I can grow revenue without lifting COGS proportionately. I just gotta get it closer to $30K and I'll have margin in the mid-80s, where it should be.

!(https://media.licdn.com/dms/image/C4E12AQGhSuNaEyjL4A/article-inline_image-shrink_1500_2232/0?e=1554336000&v=beta&t=38VsggTcrnbdH7LmloXtpC90FCTBSbKv52pX3fkbbtE)

Product update

Last month was a lot of optimization of the Toofr code. Most of my building was actually on the Inlistio front, and since Inlistio uses Toofr a lot, I even caught a couple of bugs that I wouldn't have seen otherwise. I was surprised no one else had brought them to my attention.

So I fixed those and made a bunch of small improvements to the Toofr Audiences product, further refining the title data and building a service to go out and get new data in real time when an Audience query is empty.

- Added a credits API endpoint to purchase credits and check balances- Added a flag reports API endpoint to flag bad data in Toofr and get a credit back for the report- Further improved Audience query response times in UI and API- Released a new email marketing tools page- Added social shares and made other small improvements to the Toofr articles.- Included a real-time prospector that adds people to the Toofr database for specific domains(!!)

Other projects

Here's my update on the other projects last month.

Thinbox

Sessions this month: 104 (101 last month)

Registrations this month: 2 (2 last month)

Paying customers: Still 0

Thinbox is a customer email analytics tool that still needs some love but I now have some SEO tooling that will help at least plant the passive SEO seeds on the very niche keyword set that this site needs. It's an elegant product with no external data dependencies. It would be a welcome relief to add this to my portfolio of revenue streams.

eNPS

Sessions this month: 147 (187 last month)

Registrations this month: 4 (2 last month)

Paying customers: Still 0

eNPS is an employee net promoter score survey tool that still has tons of potential. Encouragingly, I spoke to another trialing user and have a roadmap of features to add that would entice him to pay. I'm also going to explore adding HIPAA compliancy so I can target health tech companies.

Inlistio

Sessions this month: 258 (271 last month)

Registrations this month: 5 (3 last month)

Paying customers: 5 (3 last month)

Inlistio is my collaboration with Max Altschuler from Sales Hacker to track job changes on email or customer lists. The good news is Inlistio works! People like it. They're paying for it and sticking around. So far I haven't churned anyone. I was able to find a way to lower prices significantly and I have my new content marketing hire helping with posting to Inlistio at least once a week. Of note is this pretty impressive jump into the top 10 position on "track job changes" which is the cover chart this month. I'm going to start targeting other keywords now and cement this position. Big things are ahead for Inlistio. I can feel it.

!(https://media.licdn.com/dms/image/C4E12AQEZ8fGJWG8P3A/article-inline_image-shrink_1000_1488/0?e=1554336000&v=beta&t=YV8_qN9X4FhHVQSy9aTmYknVun_ncMnbUDIL5n0fWk4)

Glist

Sessions this month: 113 (launched on 10/22)

Registrations this month: 4

Paying customers: 0

Glist.io came about because I wanted to send mass emails to my friends and family and give them a polite way to unsubscribe. I was also curious about AI chatbots and found Wit.ai and then couldn't get enough of it. So I've used it myself and have four other people who at least registered and made lists. Still a ways to go on this but it was fun to build. If it gets traction it will do so via its own referral marketing mechanism: links back to Glist.io in the bottom of every email.

More from Business

- My best advice for entrepreneurs - Sun 27 April 2025

- Thoughts on building a brand - Wed 25 December 2024

- The process - Sun 29 September 2024