SOCIALS

Toofr LLC quarterly report: Q1 2018

In: Business

Tags: #toofr #entrepreneurship #business-strategy #saas

If you've been following along, yes I took a few months off from writing these public board reports for Toofr. My last one was December 2017 and then January turned to February turned to March and before I knew it I was wayyy behind on these.

But I did publish a book about parallel entrepreneurship in the meantime, so at least I have something to show for it. The lag here was not for lack of writing.

Quarterly may end up being the right cadence for me now. We'll see. The nice thing about working for myself is I can do what I want. I make the rules! Haha! But I can break them too, and when I break them, no one's there to slap my wrists. I have to hold myself accountable instead.

So that's what ultimately brings me back to this LinkedIn article. I believe it behooves me look back on the last quarter with the same level of detail and transparency and make it public, again, so I do it right. I want Toofr to keep growing, keeping adding value, and keep builing towards the ultimate goal of selling it, paying off some (or all!) of my mortgage, and working on something else for a while.

That's the parallel entrepreneur approach. (Yes I'm hawking my book again. If you like these articles, you'll love the book!)

Referral traffic update

Ohaigoogleanalytics. Missed ya, bro! Been forevs!

Yea, I should really look at these graphs in between board reports.

Picking up where we left off in December, the new year brought new referrals and we're back up to the 2017 heights. It's nice to see it working again. Referral traffic is up over 50% since the low point in December!

The referral group is the same suspects but a few of them have increased 10X due to some new blog posts, like this Ahrefs article. It's increasingly rare for Toofr to be left out of any blog posts comparing email finding tools. I used to see it pretty often, maybe 50% of the time, and now it's almost never. When a high authority site like Ahrefs links out to Toofr it really helps.

And the good news is I haven't done any manual outreach to get these links. That was my strategy last year, and if you read previous reports, it was probably the one thing I kept hounding myself on. I couldn't find the time or energy to go out and manually make the connections to get those links. Fortunately it's happening organically.

Organic traffic update

Organic traffic also had solid growth throughout Q1 this year, rebounding more than 50% from that same December low.

In diving into the organic results, it's clear the difference is long-tail traffic to Toofr articles. All traffic to my /articles path is up 250% between April 2018 and December 2017, and since I'm being much more diligent about what I'm writing about there and the keywords I'm emphasizing, I suspect this will continue to bulster organic traffic.

Interestingly, I first started to "feel" the traffic lift in January. I remember noticing more list imports, registrations, and interactions with my welcome emails. I didn't look then but it's clearly from some algorithmic SERP change. Here's a SEMRush chart that shows it.

This chart shows the visibility in Google's top 100 results on 52 keywords I care about. It says that in mid-January my keyword visibility suddenly shot up over 2X and fortunately it has held.

The reason my pages caught Google's eye? Beats me! The net result is a steady climb in organic traffic since January.

Marketplace traffic and sales update

Here's where I get the most happy and also where the SEO game has me most curious.

I got big bump in traffic in December and it fell in January but has been growing steadily ever since. The beautiful thing about the marketplace is each list is a new page with some nice rich content and it's completely user-generated. I love that.

So it makes sense that as I get more lists and therefore more pages I ought to also get more traffic. This appears to be happening.

I've also postulated that as I get more traffic and more users I should also get more list sales. This has likewise been the case.

Here you can see the dramatic increase in list purchases since January. It's remarkable really considering that I've done no--zip, zero zilch-- paid advertising on the marketplace. This growth is entirely organic. May is easily going to beat April but probably not at the same slope. It's a third of the way through the month (as of this writing) and I'm halfway to April's count. For what it's worth, the purchase amount (aka "gross marketplace value") graph has the same shape as the quantity graph.

On the bottom line front, this means that the marketplace is giving me > $1K MRR, which is about a 5% boost to my total MRR. I hope that that ratio will continue to grow. I'd love to have a business that makes 50% from subscriptions and 50% from marketplace transactions. That would be a really, really strong position from a defensive revenue standpoint. Toofr would essentially be a fortress.

Here's the traffic chart too.

Customer growth update

I loves me some customers.

December ended with 155 active customers. April ended with 179 of them. April was also my best customer acquisition month ever with 54 new paying customers. I chalk that up to traffic.

I fully expect that from now on, each new month will be my highest active customer count month ever. Next month I should close with over 200 customers. I've always thought that at 300 customers I'll really, truly have my lightning in a bottle, an asset that undeniably will be worth a meaningful amount of cash. I'm more than halfway there now, and with each passing month, I feel more confident that I can predict when that 300 customer mark will happen.

Then I'll be ready to sell this thing. If you're reading this and want to buy, hit me up at the end of the year. I'll tell you when we can do the deal. At 300 customers I will be able to fair value Toofr at the price I want to sell at. And then I can let her go.

MRR and cash growth update

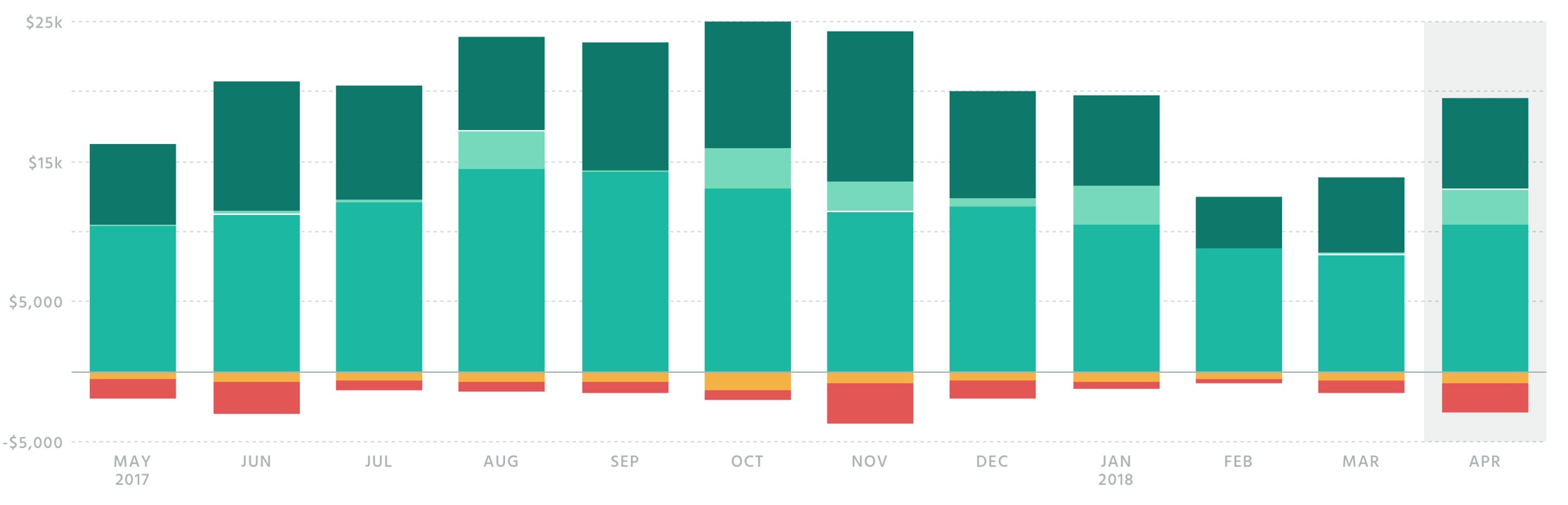

And now I'm going to shoot myself in the foot. MRR has been a lagging indicator, so this graph isn't nearly as pretty.

Let's just get it out of the way.

Yep, December to March was a slow and steady death march. It sucked. At the start of each month I'd inevitably be greated by the news that a $500/mo customer wanted to cancel. Then a $250/mo one. And even though I was netting new customers each month, those new customers would inevitably of the $19-49/mo variety. In simple terms, I was losing good customers and gaining less good ones.

I knew at some point the bleeding would have to stop. Eventually, I would churn my last big customer and my MRR would turn the other way. I believe that happened in April (although May 1 literally greeted me with a $500 not-totally-unexpected MRR churn) so from here on it would be up and to the right.

I also still have a fair amount of one-off (including marketplace) transactions to cheer me up, so cash is still livable.

A little case study for those still reading: that January-February drop came from a customer who was accumulating a lot of overage charges. Each overage charge is accompanied by an email receipt, and this one user kept racking them up. I'd been in communication with them at several points to update their credit card, which they promptly did, and I just let it ride. Eventually new management came in and cleaned up their account, pushing them over onto a cheaper plan. That was the big drop. So the point of this case, and the lesson I took away, is to not treat those customers like real revenue. I should have asterisked about $5K/mo as "risky" or "likely to churn" and that would have pegged my MRR lower. That lower MRR might have changed my perspective on marketing activities.

Instead, I admit to getting a little fat and happy in Q4 last year. There's a roughly 40% drop between my October cash peak and my February cash trough. When you're relying on your on business to pay the mortgage, that's a real kick in the ass.

Lesson learned: Be real with yourself about the quality of your revenue.

Other projects

I'm just going to talk about two of them from now on. They're the only two making money.

Inlistio

Inlistio has really come into its own since my last writing. The tech is great, the customers are happy, and the demos make me feel like shoot, what have I been doing wrong all this time on the Toofr front??

It solves a problem people hate: their contacts change jobs but their CRM data stays the same. They need that data to be dynamic, and Inlistio is the best thing on the market to do just that.

Since December I've pulled in almost $20K in Inlistio revenue, a bulk of it from two one-time projects. My goal now is to find a way to make it recurring. I'm confident that with enough regular outreach I'll get there. Traffic for Inlistio has been climbing too, albeit from a low base.

VoxLoca

Voxloca got its first customer recently, a large city in the SF Bay Area running a survey for $3,000. This is my collaboration with a political consultant I got to know from my time interning for (then) Lieutenant Governor John Garamendi. My partner knows the market, knows the customers, and needed a product person to build an SMS-based survey tool.

It's essentially my first "official" gig as a CTO. It's been a great experience, and I'm already reaching out to my own local city managers to see if they want to run some surveys too.

We're disrupting an industry that feels backward and ancient: traditional pollsters who rely on call centers and think email-based surveys are an innovation. We're SMS-based, faster, cheaper, and better than the traditional pollsters. It's a fun and really interesting gov-tech project and I hope it continues to make money.

More from Business

- My best advice for entrepreneurs - Sun 27 April 2025

- Thoughts on building a brand - Wed 25 December 2024

- The process - Sun 29 September 2024