SOCIALS

I'm down with ICP

In: Business

Tags: #shovels #startups #marketing #entrepreneurship

I became a better entrepreneur in the last few months. I have never thought so hard about ideal customer profiles (ICP), had so many conversations with marketing experts, or written so much about this to my investors.

The net result: it's another superpower. I'm finding that thinking hard about ICP, having the stamina to keep doing it and the skill to do it well, is special. It sets an entrepreneur apart and puts their business on stronger footing. In short, figuring out your ICP is akin to seeing the future.

The Shovels ICP: A case study

I've been doing all this ICP work for Shovels, of course. I never thought twice about the ICP for my side projects; the stakes were too low. Who cares? Just build and let the chips fall where they may.

Shovels is too interesting. It's too big, there's too much surface area to look at. With Shovels, I want to get it right. It's my baby, my reputation, my investors' money on the line. I have a co-founder and a team this time. I want to go all the way. Figuring out the ICP for Shovels has been a struggle but I think we may have it figured out now.

The hard thing about ICP is that it's multidimensional. I think of see ICP on two axes: the what and the who.

The what

For example, here are just a few of the ways I have described the "what" of Shovels:

-

An API for building permits

-

A database of permits and contractors

-

A building contractor directory

-

A list of contractor recommendations

-

A marketing solution for construction companies

-

Permit histories on any address

-

A sales intelligence platform

The "what" is meant to be what we offer. It's the actual thing that people buy. I can spin Shovels in a lot of ways on this axis. It changes based on who we talk to, what we're building, and what I'm most excited about at the time.

The who

Tho "who" is who's buying. It's the "profile" in ICP. Fortunately, I can look empirically for this answer. I have hundreds of registrations and dozens of customers to base this answer on.

Unfortunately, there is no majority. Among the many profiles are:

-

Climate tech companies

-

Construction tech companies (who sell to contractors)

-

Property tech companies (who sell to homeowners)

-

General contractors

-

Banks

-

Financial tech companies that work with banks

-

Building materials suppliers

-

Real estate data aggregators

-

Energy utilities

-

City managers

The list goes on. It's nuts. We use to watch this list grow in awe. It made me feel good -- so many different types of customers see value in Shovels! We're onto something!

While true, it also makes messaging a challenge. Each of the profiles has a specific twist on what we're building. They may share some fundamentals, but on the edges they are different, and you can't please everyone.

The matrix

As I said in the beginning, an ICP is where the "what" meets the "who." A nice simple ICP structure, a one-sentence tagline, is something like "Shovels is the what for who."

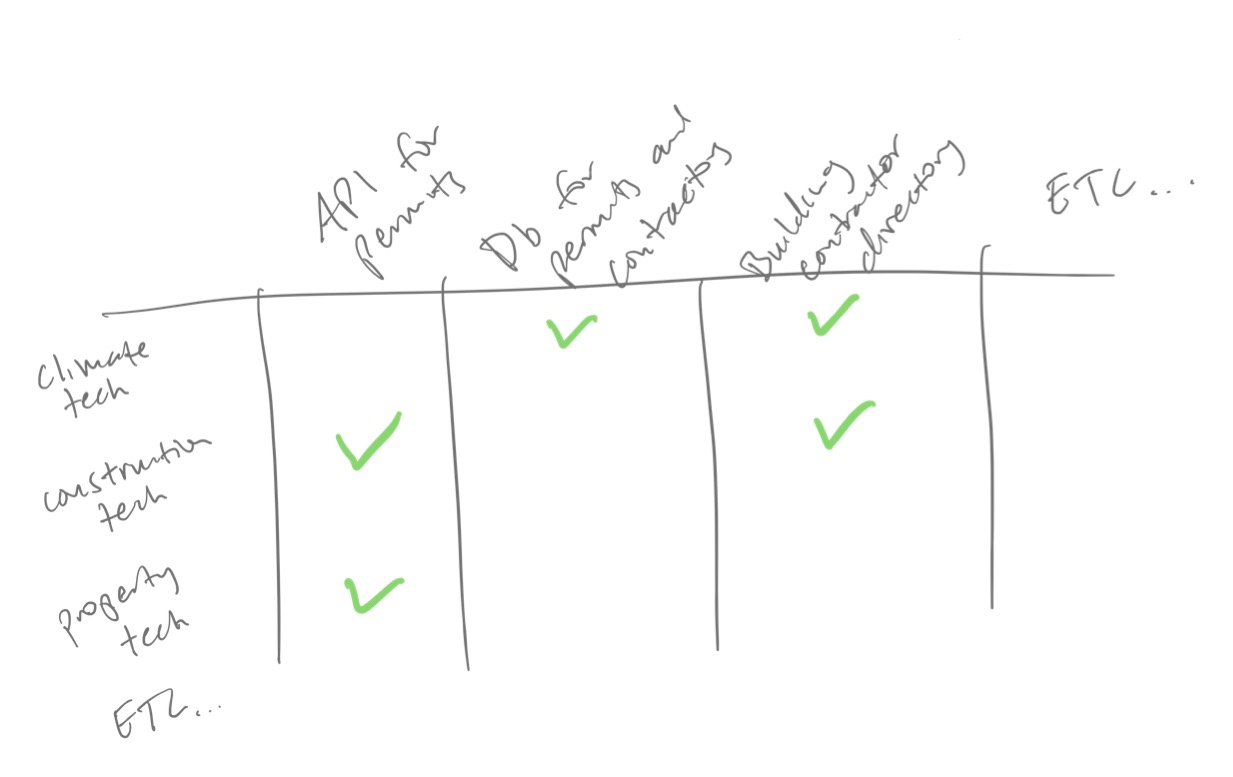

The challenge, as you might have guessed, is that the "what" is different for each "who." I could create a two-dimensional matrix with each "who" on the y-axis and each "what" on the x-axis. Where the who and the what intersect is a match.

For example, I know that climate tech companies (the who) want an API for building permits (the what). I also know that construction tech companies (the who) want a contractor directory (the what). Many profiles want more than one thing.

Shovels can provide a lot of things to a lot of profiles. So, are we "an API for building permits and a contractor directory for climate tech and construction companies"?

That's clunky, but it's a place to start.

However, with many of these intersections to consider, we'll have to prioritize, and I've learned that it's best to prioritize on the "who." Products can change; profiles can't.

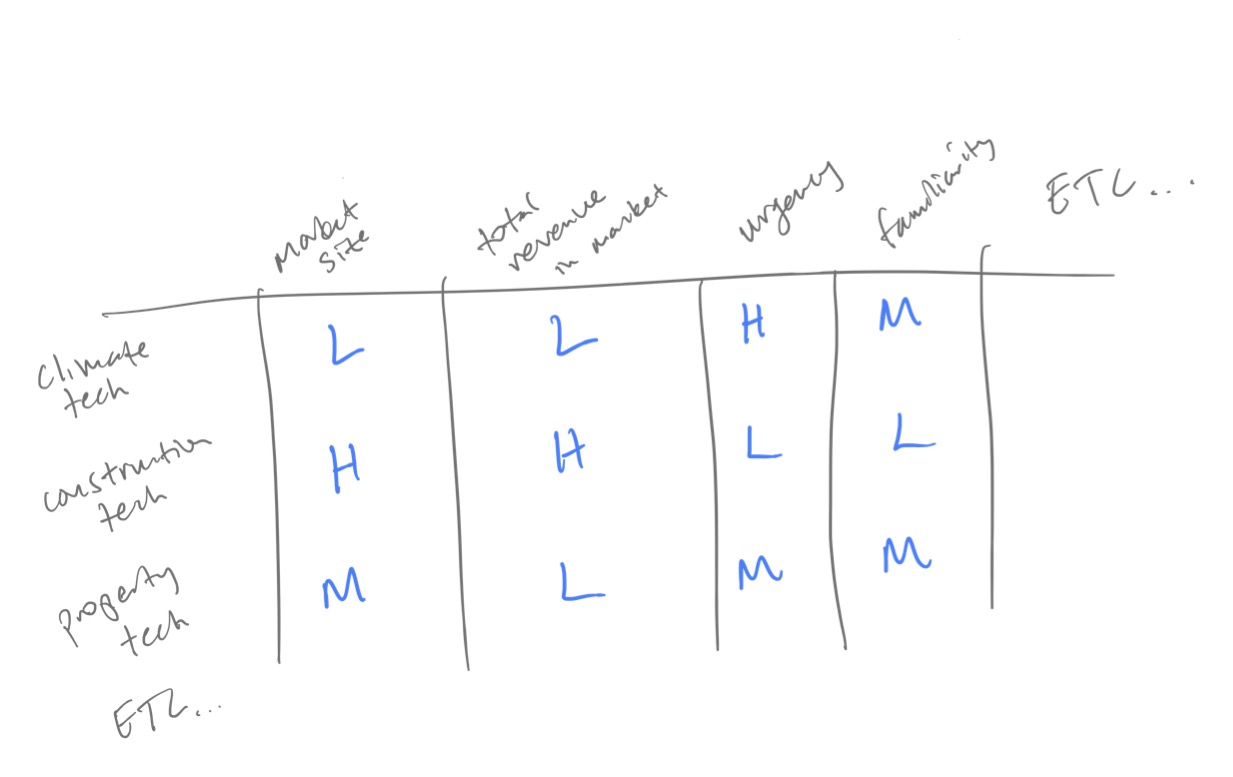

We've been working with a couple of market strategists to get this right and I learned there are a few ways to prioritize our profiles:

-

Number of them in the market

-

Total combined revenue

-

Distribution of revenue (ideally there are a lot of big ones rather than a few super massive ones)

-

Urgency to use us

-

Familiarity with our use case

If I look at each of our profiles through this lens then it gets a lot easier to see the differences.

The choice

We can rank our profiles across these priorities as low, medium, or high. Here's a start.

It gets us closer, but you can see there's not an obvious winner. We have a few options to sort this out further. We could weight the priorities on top. I'm assuming that they're worth the same; they probably aren't. We could add more priorities and more profiles. Maybe I need to be more specific (e.g. "climate tech companies who work with heat pumps").

This is where the work comes in. It's an ongoing process to drill in, refine, zoom out, and see where we're at.

Conclusion

We spent a lot of time doing this and I think we've landed in a good spot. We have a BIG profile. They understand our product and they have urgency. We have some proof points in our pipeline and I suspect that we'll have our first paying customers in this category very soon.

What is this profile, exactly? Not telling! It will emerge in our marketing over time, but I don't want to make the announcement yet. We still have more work to do.

More from Business

- 0 to 1, 1 to 10 - Sun 29 June 2025

- My best advice for entrepreneurs - Sun 27 April 2025

- Thoughts on building a brand - Wed 25 December 2024