SOCIALS

I’m not shaving until my company is profitable

In: Business

Tags: #entrepreneurship #startups #business-strategy #transparency

I’ve been the CEO of Scripted and it’s never been profitable. More like ten years if you count my pre-pivot company too. Even when we didn’t have employees, we still weren’t profitable. We actually didn’t lose a lot of money back then, but we didn’t make a lot either.

Then we raised $18M and we really weren’t profitable. In fact, instead of making money, we burned about $450,000 each and every month.

We basically lit a $450,000 home up every month and watched it burn to ash. Then did it again the next month. And the next.

Every. Goddamn. Month.

For two years.

This is what it’s like to run a startup: start of the month -> end of the month.

This is what it’s like to run a startup: start of the month -> end of the month.

Let that one sink in. About $8M dollars lost while we struggled to find product market fit and hired a lot of expensive managers, agencies, and consultants.

We built a lot of great product too, which will probably end up saving the day, but yeezus, we could have figured out how to not burn $900,000 houses to the ground a little sooner.

You know what? You live, you learn, and you try hard to avoid Einstein’s definition of insanity. If I sound bitter, though, it’s because we weren't moving fast enough. Not fast enough, at least. For a couple of years there my company was just plain batshit insane.

I spent the better part of this week perusing through three years of board presentations, trying to understand why I ended up here: 10 years into my career, the third CEO of a company that, since 2011, has spent $22M and lost $18M. (Which means along the way we managed to make $4M of gross profit!)

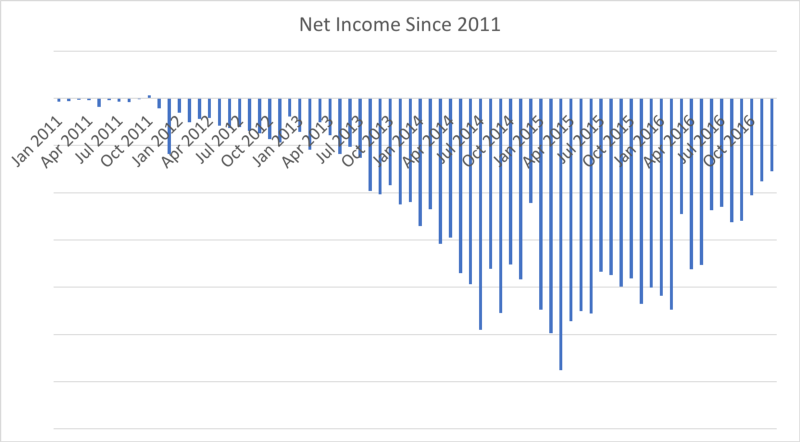

By the way, here’s what losing $18M over five years looks like.

These blue bars are monthly losses, and they grew with our fundraising milestones. That’s by design, of course. You raise money in order to invest in activities that are not profitable in the short-term. It’s the leverage you use to expand faster than your competitors. This is the weapon that Lyft and Uber are using against each other: unprofitable growth. The hope is that you can course correct your expenses later when the revenue machine is humming. Then you quickly make all those losses back.

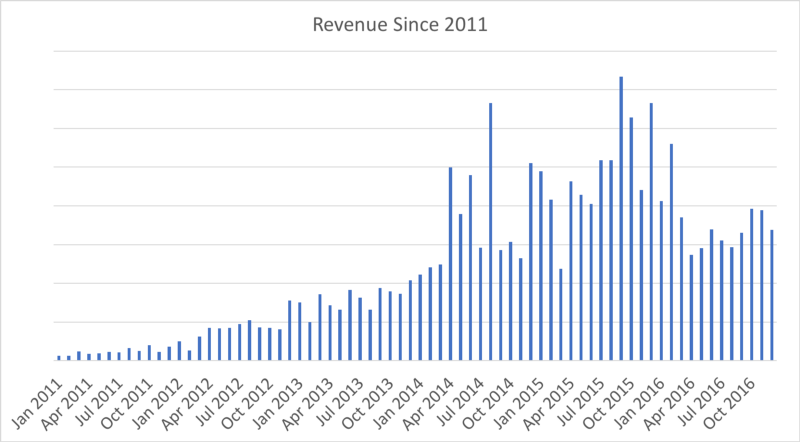

We raised $4.5M in summer 2013 and $12M at the end of 2014 with the objective of accelerating our revenue growth. We hired a terrific sales team and scaled our marketing operation with it. The problem we discovered, ultimately, was that our customers had some fundamental issues with our product and the way we were selling it.

For a short period, revenue did improve after we raised money.

Here’s that chart.

The problem appears when you overlay the net income and revenue charts. Losses grow when revenue grows. We have to keep spending more money in order to keep making more money. In fact, for every new dollar we got, we had to spend more than a dollar to get it. In other words, our unit economics were negative. This is bad, and it almost killed us.

Fortunately, we made some hard choices recently and are a-l-m-o-s-t profitable. In a few months we will reach that promised land.

Until then, I ain’t shavin.’

More from Business

- My best advice for entrepreneurs - Sun 27 April 2025

- Thoughts on building a brand - Wed 25 December 2024

- The process - Sun 29 September 2024