SOCIALS

Business evaluation: Ahoy

In: Business

Tags: #business evaluation #web3 #blockchain #politics

*Edit: Ahoy is now live so I've included links. *

I'm still working on the web3 project I ({filename}my-foray-into-web3.md). In November 2021 I wrote a white paper of a fundraising tool that I hoped could be used to influence votes on climate legislation. Rather than collecting signatures, this project would collect cash, real dollars, and release that cash conditionally on voting outcomes. It would function like a PAC but exist in broad daylight, meant to "put our money where our mouth is" and quite literally pay for votes.

The same approach could be used for election results. Candidate A could have a primary election fund and a general election fund. If they lose the primary, then the general election donations get refunded in full. A soaring balance in the general election fund could indicate momentum and maybe change voting behavior because people would want to back the person with the most to lose.

In fact, this idea of paying for somebody to do something and keeping that value locked up in a contract until they do it, at which point it gets released, or refunded if they fail to do it, is a general bounty problem. Earlier this year a couple of guys working on that general bounty problem read my November 2021 project description and loved it. They reached out and I've been talking to them ever since.

They call their bounty app Ahoy.

Ahoy isn't live yet. I'll link to it once it's available to the general public (which should be soon, I'm told). Ahoy! For this business evaluation I'm going to describe the business opportunity of Ahoy generally and my political fundraising idea specifically.

The Problem

Ahoy solves a few problems, some more real and applicable than others. I'll list them in no particular order.

- All online fundraising requires exorbitant amounts of trust- Our climate is changing and that is already massively disruptive- The will of the people isn't always expressed in the law- Blockchains aren't used to do enough interesting things in the real world

Please indulge me in an expansion of each of these points.

Trust in fundraising

Let's say you get an email from a non-profit organization asking for a few of your hard-earned dollars so they can continue doing their work. You can trust that they're a non-profit; it's possible to look them up on third-party websites. You can trust that they do good work; you can find articles and testimonials. It would require a lot of effort to spin up all this online evidence to support a fake NGO, and the payoff would be questionable. So the fact that the NGO exists and does real work can be trusted.

However, as a donor you have no visibility into their fundraising. They could be backed by bilionaires and still come out asking for your money. NGOs don't have to disclose their fundraising reports the way politicians do. You simply don't know if the $250 they ask for is a meaningful addition or a drop in the ocean. Is your donation going towards rent at their swanky New York headquarters or actually helping hungry children? You don't know because you can't see their bank account balance. You don't know what goes in or what goes out.

It gets more interesting when we consider the popular "matching grant" fundraising technique. Here's a letter from an organization I admire, the Environmental Voter Project. Note the highlighted circle at the bottom.

There's no way for me to know if this matching donor actually exists. It could be simply a marketing technique, and I suspect that most of the time that's all it is. It's hard to fundraise. There's a lot of competition for attention and donations, especially in this climate of falling stock prices and rising inflation. Donors could be misled out of desperation. It's still not ideal for those of us who donate.

The climate is changing and I hate it

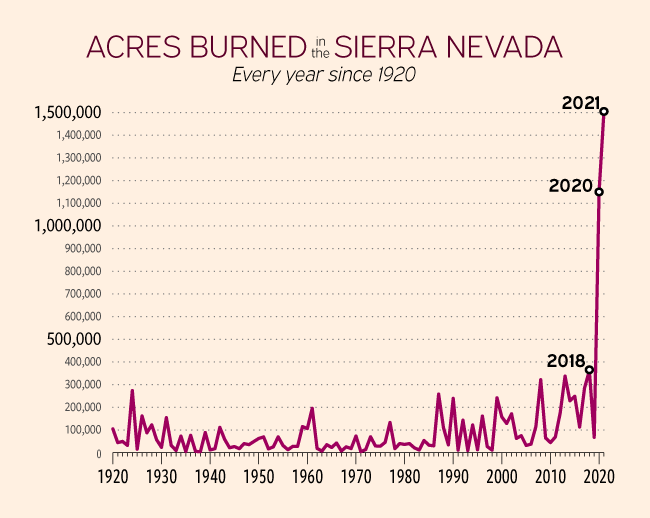

There was no wildfire season when I grew up in Mountain View, California. I've been going to ({filename}my-happy-place.md) in the Sierra Nevada mountains my entire life. I used to spend the month of August up there with my grandparents. I never caught a whiff of a wildfire. Not once.

We don't go to the cabin at Pinecrest Lake in August anymore. We can't plan our vacations around the uncertainty of being smoked out. It's happened the last two years in a row. Before that, ashes fell on the lake during the Ring Fire near Yosemite. I can't say it clearly enough: This is not normal. My grandpa wouldn't recognize it.

You're crazy, Ryan, you might argue. Wildfires have been happening for millions of years. What do you mean it's not normal?

*https://sierranevada.ca.gov/2021-another-historic-sierra-nevada-fire-season/ *

*https://sierranevada.ca.gov/2021-another-historic-sierra-nevada-fire-season/ *

It's not normal.

The will of the people is not expressed in law

Books have and are being written on this topic. I'll just brush the surface here, focusing on the cause and the symptoms.

The reason why unpopular laws get passed is the same reason why unpopular presidents get elected: we put extra weight on the voices of rural America. This philosophy probably traces its roots all the way back to King George III and the founding fathers' revulsion to rule by aristocracy. Wealth tends to aggregate in the cities so the framers ensured that rural, less populous states get an equal vote. This is why we have the Senate.

The Electoral College was set up specifically to handle the presidential election. It distributes electoral votes by the sum of the House and Senate seats in each state. The two extra Senate-based votes may not seem like much but it has tipped the scales against the popular vote more than once (Bush v Gore in 2000 and Trump v Clinton in 2016). Case in point, Wyoming influences the presidential 3X more than other states:

On average a state is awarded one electoral vote for every 565,166 people. Wyoming has three electoral votes and only 532,668 citizens (as of 2008 estimates). As a result each of Wyoming's three electoral votes corresponds to 177,556 people. Understood in one way, these people have 3.18 times as much clout in the Electoral College

https://www.fairvote.org/population_vs_electoral_votes

Is that fair? Doesn't seem like it. Is it by design? Youbetcha.

As much as I'd like to see Electoral College reform, primarily because it's an antiquated institution put in place when literacy rates were much lower and information about presidential candidates was harder to come by, I know it won't happen. The very system that gives rural states their voting power would need to be used to strip that power away.

In other words, we're stuck with it.

Blockchains aren't used to do enough interesting stuff in the real world

Right now blockchains are used to do two, maybe three things.

- Speculate on cryptocurrencies- Prove custody of certain digital properties- Become a modern baron

Unless you really never read a newspaper or watch a Super Bowl ad, you've become familiar with the rise and fall of cryptocurrency prices. You have coworkers, family members, and friends who struck it rich or lost it all on Bitcoin, Ethereum, or whatever the flavor of the month is on Coinbase. This crypto casino is the #1 use of blockchain right now.

The last year also saw the rise of non-fungible tokens (NFTs). These are basically transferrable contracts that have some unique digital asset associated with them. These days, that asset is a funny looking, unnecessarily pixelated artwork of some animal doing something silly, like smoking a cigar. There are more interesting examples but I'm very biased against NFTs and can't think of anything nice to say about them.

Finally, and this is more sensitive because some of these barons are my friends, but crypto has become a very efficient way for entrepreneurs to get absurdly rich. Mind-bogglingly, insanely rich, in a very short amount of time. I met my first billionaire when I was an MBA student. I figured I'd never meet another one. Now I know about five who made billions of dollars in three short years.

Put in perspective, my most successful MBA friend (probably the most successful for several years on either side of our graduating class) started his company in 2009, went public in 2017, and is worth only a couple/few hundred million dollars.

How does this make sense? It doesn't. It defies logic, but then again, who am I to say what's logical? I'm probably just jealous, as I've ({filename}above-average-mediocrity.md).

Regardless, I'm quite certain none of this is great for crypto. We need more real-world, rising tide-style uses for blockchain where the winners don't stand on the backs of the losers.

The Solution

Going back to where we began, the founders of Ahoy reached out because they loved the idea of using bounties in politics. If you do X, we pay Y. It's fundraising based on results rather than promises. You only get the money when you show us the goods.

This solves the problem of trust that I led with up top. On a blockchain the wallet balances are public. You can see every ledger transaction. You know when and where a transaction goes, and if the wallet has some public identity, then you know who it goes to as well.

If politicians used crypto wallets exclusively we wouldn't need quarterly reporting. It would already be public, available in real-time.

If an NGO wanted to set up a matching grant campaign, we could see both wallets, the NGO and the matcher. When I donate to the NGO, I could see its balance go up 2X my donation and watch the matching wallet drop by the amount I donated. I could verify that my donation is matched. And if the NGO claimed to have a $10,000 match, I could see that in the matcher's wallet balance, clear as day. It would be completely trustless.

There's something really clean about this approach for NGO campaign fundraising. It gets messier for politics. If everyone knows there's $5M in a wallet and those funds will get distributed automatically to every senator who votes in favor a bill, that will make the opposing side uneasy. I argue, though, that this is what already happens. The only difference is we're being transparent about it. Glaringly transparent. If that makes you uneasy then let's call back another Supreme Court decision and stop giving companies "freedom of speech" in political donations.

I think it will be useful to have this debate.

In the meantime, we can use Ahoy to influence climate change legislation by doing direct legislation bounties or fundraising for elections. In fact, any law that is widely unpopular (two that are timely: abortion prohibition and gun rights) is fair game here. If a majority of the American people believe one thing and the laws state another, then we wound up here because something tipped the scales against the majority.

Let's use Ahoy to tip it back.

And this way we use a blockchain to actually do something useful.

The Business Model

This time I'm adding a new section here because it's not obvious how Ahoy itself or anyone involved with the bounties makes money. I'm a capitalist at heart. I believe even the best intentioned still need to make a buck. And as I told my Intro to Business class many times over: without profit, a business dies. No exceptions.

We want Ahoy to survive, so we need it to make money.

There are a few tried and true business models that we can discuss here. Ahoy could implement one or all in order to keep the lights on and incentivize its most valuable users.

- Setup fee- Transaction fee- Subscription fee- Tokenomics

Setup fee

A setup fee is a bit like a deductible in health insurance. Sure, it generates some money, but the real value to the company is setting a buy-in so neither side wastes their time.

There's a whole social science behind deductibles but the basic theory states that pure subsidies are prone to abuse. If you make healthcare cheaper, people will use more of it. We don't necessarily want people to use more of it, we just want them to be able to afford healthcare when they need it. The deductible sets that bar for need.

A setup fee could work the same way. To make sure that only serious people use Ahoy, we could implement a $200 or even a $2,000 setup fee. Only the people who look at that and think it's worth it will pay. And then Ahoy filters out the chaffe and knows that each user is real.

Setup fees generally aren't the core of a business revenue model and I wouldn't expect it to work really well for a mostly consumer play like Ahoy.

Transaction fee

So maybe we don't want to filter anyone out. Maybe it's worth it to us to deal with some tire kickers because they might go and tell more people about Ahoy. It's hard for something to go viral if it's gated.

In this case, we charge a transaction fee. For every dollar that passes through Ahoy via a bounty, Ahoy takes three cents, or five cents, or a quarter. Transaction fees can work on a schedule, scaling up or down with volume. This model is how the whole financial system makes money. It's how Uber and Scripted, Amazon and Apple worked. Transaction fees are great so long as you have liquidity in the marketplace and funds keep moving. Low volume means low revenue. If it never picks up, you never make money. But when it works, it works wonderfully. You get rich.

The trick, like any pricing game, is to make the take rate just high enough to maximize revenue without turning people off and trying to go around you. That's the risk at Upwork, for example. If I like a freelancer, maybe I'll offer them 5% more (since Upwork takes 10%) to work with me directly. Same with Ahoy, if we charge too much, they may try to pay the bounty target directly.

Subscription fee

I love me subscription business models (monthly recurring revenue). We could charge bounty creators a monthly fee for hosting the bounties or even for promoting them. Once Ahoy becomes large enough, there will be a need to rank the bounties on the homepage and include them in email marketing. This could be pay-to-play scheme, prioritizing those who are subscribers.

As with most SaaS businesses, a free tier is usually best practice. We want the tire kickers, after all. But if we're clever with certain features and promotional opportunities, we can probably entice a fraction of the creators to pay a fee.

MRR is nice because it's predictable. With predictability comes stability and confidence that the company can invest ahead of growth. Investors love it too. While you can still become a huge company without MRR (looking at you, Stripe) it's harder to do that these days. You need massive volume to make up for the lack of predictable revenue.

Tokenomics

Finally, we get to the wild card. Tokenomics is the idea that a project can create its own cryptocurrency and use it cleverly to incentivize behavior that benefits all token holders. We can turn using Ahoy into a little game. Create a bounty, get some tokens. Raise $10,000, get some tokens. Get enough tokens, join the special Ahoy governance council.

Then you make the tokens transferrable, throw some up on a decentralized exchange, and let people buy them. A price gets set by the market, and that stash of a million (or five million) tokens you set aside for yourself is all of a sudden worth... millions. Don't believe me that this happens? The top 20 wallets for ConstitutionDAO have millions in value (more like $1.5M just a few months ago). The top handful are worth tens of millions. I can't know for certain but I assume these are the founders' wallets.

These guys are the modern crypto barrons, the people at the top of the totem pole who are able to literally print their own money. It's (mostly) unregulated, certainly nothing like the stock market where companies have to jump through hoops to print more of their own paper.

So it's fun when you're one of the lucky few who make it to this position. It could be a great way for Ahoy to make money, and others would surely benefit along the way. It's not just the founders of these early tokens who got rich. Many others did too, but the founders got the richest... by far.

My recommendation

I like a transaction fee and tokenomics. Setup fees and subscriptions are too heavy for a consumer play like Ahoy. We need volume. Everyone wins if there's volume. Transaction fees and tokenomics depend on it. If we win, we win big. That's the kind of game I want to play right now.

I don't own Ahoy. I'm not even an official advisor. To the extent I've written "we" above, it's just because I feel some sense of ownership over how we do the political stuff.

I'll recommend this to the founders of Ahoy and I'll post the link here when it's live. And maybe I'll get some tokens.

See you at the top.

More from Business

- 0 to 1, 1 to 10 - Sun 29 June 2025

- My best advice for entrepreneurs - Sun 27 April 2025

- Thoughts on building a brand - Wed 25 December 2024